The ERA/IRN RentalTracker for the fourth quarter of 2022 confirms the faltering confidence in Europe that was first hinted at in the June 2022 survey, but there is no collapse in sentiment. Murray Pollok reports.

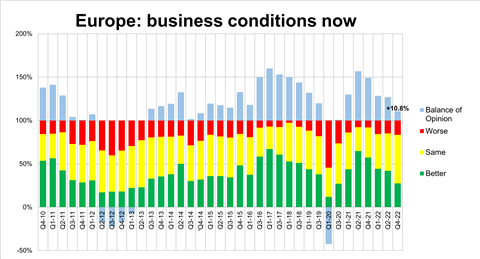

There remains a positive balance of opinion on current business conditions in Europe, but only just. More than 100 rental companies responded to the ERA/IRN RentalTracker survey at the end of 2022 and first week of January, with 28% reporting improving conditions against 17% seeing deteriorating conditions – a positive balance of 11%.

That positive result is good, although it is the lowest figure since the Q3 2020 survey, which was undertaken in the middle of a global health crisis that you don’t need to be reminded of.

Rental business conditions in Europe at the end of 2022. (Image: IRN)

The fact that 72% of respondents are either seeing no change to conditions (56%) or worsening (17%) may not seem terribly positive, but given the Ukraine war, rising interest rates and global GDP slowdown, it may actually be a much more positive result than we could have expected.

It is true that there is a gentle deterioration across all the measures – business volumes, fleet utilisation, capital expenditure plans, employment intentions – but in each case there remains a positive balance of opinion.

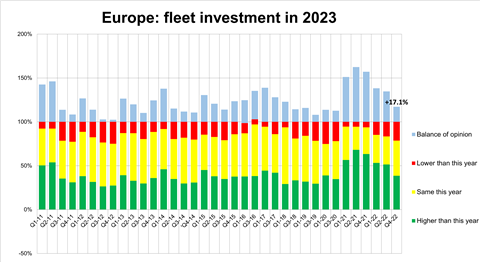

Capital investment

At the end of June 2022, more than 50% of respondents were expecting to increase their capital investment in fleet in 2023. By the end of the year, that had fallen to nearer 40%: meaning that the clear majority will stick to 2022 levels of spending or reduce it.Even so, more will still increase spending than will reduce it, which is an encouraging sign and reflective, perhaps, of a supply chain that has struggled to give rental companies all the equipment they wanted in 2022.

Fleet investment plans for 2023. (Image: IRN)

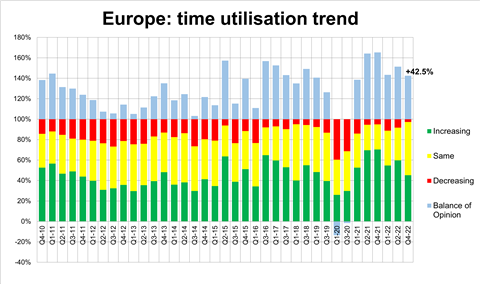

Time utilisation on fleet remains strong, according to the survey, with a tiny number – less than 3% - reporting lower utilisation and around 45% seeing continued improvements. Around half reported no change. Again, this may reflect an ‘artificial’ choke on fleet growth caused by supply constraints.

The positive finding on utilisation follows similar results in all the surveys undertaken since the first quarter of 2021, when the recovery from Covid was in full flight.

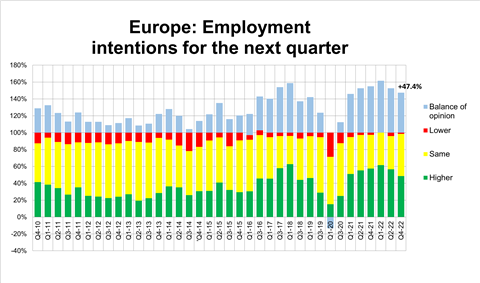

Employing more?

What about employment intentions? The desire to adds staff has been a feature of all the RentalTracker surveys since the start of 2021 and that remains the case in this latest survey in Q4. Only one out of the +100 respondents was expecting to reduce their workforce in the first quarter of 2023, and there was an even split among the rest about whether they would add or maintain current staffing levels.The employment question comes with a complicated backdrop – changing employment patterns post-Covid; an ageing workforce; and shortages in skilled mechanics. Generally, the equipment rental sector is struggling to attract new people to the industry, and that is reflected in the large number of companies still looking to expand recruitment even as the wider economy flattens.

Expectations for how business will be in 12 months’ time also results in a positive balance of opinion: 40% expect business to be better, 45% expect it to be the same, and less than 15% expect it to be worse. That positive balance of 26% is slightly better than Q2 2022, but significantly lower than in 2021. It seems that Europe’s rental sector is hopeful that the energy crisis will be over the worse and that the forecast global recession will be shallow and not prolonged.

Time utilisation trend reported by European rental companies at the end of 2022. (Image: IRN)

National differences?

The tables give an indication on how business sentiment varies around Europe. It is difficult to be certain about these national trends because the sample sizes for individual countries tend to be relatively small, which is inevitable given the total number of responses of 102.That said, the good response from French companies only allows us, unfortunately, to report that the country seems to be the least buoyant of all European nations. It is bottom of all the tables on these pages in terms of intentions to invest, business activity, utilisation trends, and business levels in the final quarter of 2022. Only in employment intentions does it come off the bottom place, replaced by the UK.

However, most notable is the fact just 4% of respondents in France reported improving business conditions at the end of 2022. That finding is in agreement with a recent DLR association survey which reported deteriorating confidence.

The UK is also below average on most counts, although it is not so much the levels of confidence that catch the eye – 50% will still increase spending and 60% reported a better 2022 Q4 year-on-year – but the deterioration since the Q2 survey last year.

Employment intentions by Eurropean rental companies in the first quarter of 2023. (Image: IRN)

In as far as it is possible to say, the Benelux, Germany and Spain are the nations that seem to be most positive about business conditions. Spain continues to recover from a difficult period, and Germany’s rental sector has performed well for several years.

Although there may be a tendency to view the Q4 results negatively – because that is the overall direction of travel - it is worth remembering that the balance of opinion on all the measured categories remain positive. That illustrates the resilience of the rental market, which seems to be real rather than imagined.

By Murray Pollok - 16th January 2023